Do You Have A Warrant? Do You Want To Avoid Going To Jail?

How much might your insurance go up after you receive a speeding ticket?

If you pay a speeding ticket, and do not complete traffic school, hire an attorney, or have the court reduce the violation, you may be in for a surprise. Many people do not regularly receive traffic tickets, and they do not know the full consequence of what might happen to their insurance premiums.

CarInsurance.com has an article from September 2019, wherein they have taken research from six major insurers, in 10 zip codes in every state, and provided a chart that shows just what you can expect if your speeding ticket remains a moving violation. We are not the authors of this information so you will need to visit their website to understand the methodology used and all disclaimers related with their research and findings.

https://www.carinsurance.com/how-much-insurance-goes-up-for-speeding-ticket.aspx

| STATE | % Increase 11 to 16 mph over | Dollar Increase | Percent Increase 16 to 29 mph over | Dollar increase | Percent increase over 30 mph | Dollar Increase |

| NEVADA | 20% | $316 | 21% | $339 | 29% | $460 |

Important things to know

- If we represent you and your violation is reduced to Illegal Parking or Rural Speed, in most cases this is a type of offense that Nevada courts do not report to DMV.

- Often times people who are not familiar with how this works are upset that their fines are not as low as they would like, while completely neglecting to realize that the savings were related to possibly not having their insurance premiums dramatically increase for three (3) years.

- Not only can your base insurance premium increase, if you have a safe driver discount that is lost as a result of a moving violation, it is possible that your increase could be even higher still.

- Receiving multiple tickets can cause your rating to go up, even double, and you might then be classified as a high risk driver.

- Examples of some factors that are used when calculating insurance rates: Geographical location, age, gender, marital status, years of driving experience, driving record, claims history, credit history, previous insurance coverage, vehicle type, vehicle use, miles driven annually, coverage’s and deductibles.

- The following are examples of moving violations and the demerit points against your DMV record (they also can cause your insurance to go up if you don’t get them reduced to non-moving violations: speeding 1-10 over (1 pt), speeding 11-20 (2 pts), speeding 21-30 (3 pts), illegal u-turn (4pts), HOV (4pts), driving in restricted access area (4pts), failure to maintain lane (4pts), failure to decrease speed (4pts), failure to dim lights (2 pts). For more demerit point examples check our demerit point list here.

Contact us now!

See how we can help you avoid having your insurance increase!

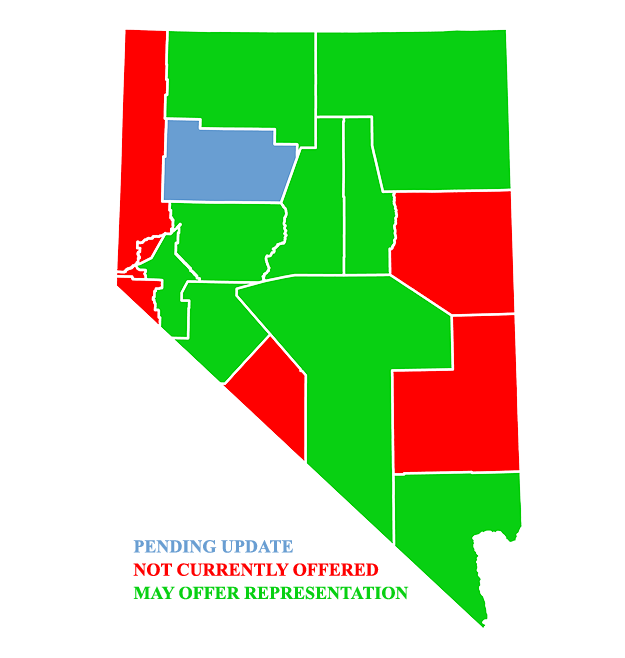

COURTS WE HELP WITH

Awards Affiliations Organizations Memberships

.

Get A Quote Today

All fields marked with an * are required.